closed end loan definition

I Home improvement loan means a closed-end mortgage loan or an open-end line of credit that is for the purpose in whole or in part of repairing rehabilitating remodeling or improving a. A closed-end mortgage also known simply as a closed mortgage is one of the more restrictive home loans you can get.

What Is A Personal Loan And How Does It Work Credit Karma

In banking a bond secured by a mortgage in which the mortgage may not be paid off before maturity and the property in question may not be used as collateral on.

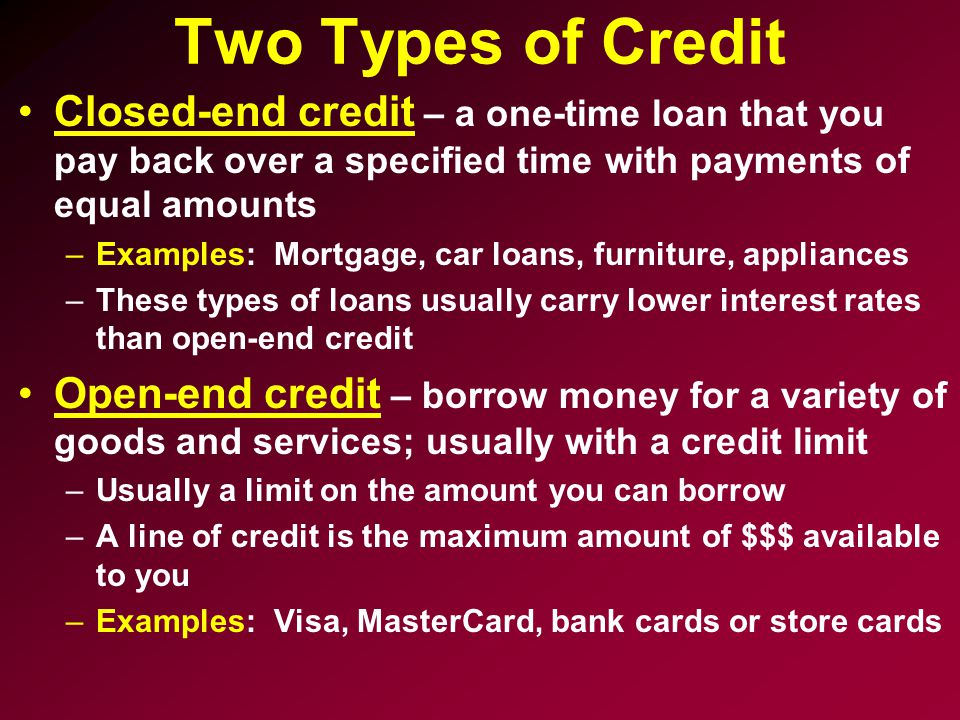

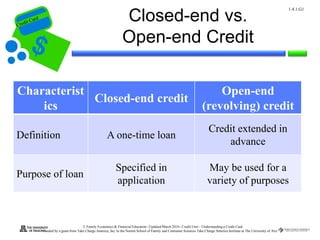

. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. A closed-end loan is a type of credit in which the funds are distributed in full when the loan closes and must be repaid in full including interest and finance charges by a specific. In contrast an open-end mortgage allows the principal balance to grow.

Home equity loans are closed-end loans secured by your home as collateral. The open-end loan is a revolving line of credit issued by a lender or financial institution. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period.

Definition of closed-end loan words. Closed-end Mortgage Definition A mortgage loan that has been fully financed at the time of closing. Noun closed-end loan A closed-end loan is a loan such as an auto loan with fixed terms and where the money is lent all at once and paid back by a.

A closed-end loan allows individuals to access a fixed sum of money that can be used to finance the purchase of a major asset such as a home or vehicle. With this type of loan you cant renegotiate the mortgage refinance. Your lender may foreclose on your house if your payments are 60 to 90 days late.

Collecting and collected mean the servicing of a loan or receipt of paymentsfrom a borrower for a loan. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a. A loan can be of two types.

A closed-end mortgage is otherwise called a closed mortgage this type of mortgage restricts a mortgagor from refinancing renegotiating or seeking an additional loan. A closed-end home equity loan lets a homeowner take advantage of a homes equity to borrow money for debt consolidation home improvements and other significant. Auto loans and boat loans are common examples of closed.

Closed-End Second Mortgage Loan means any Mortgage Loan secured by a second lien on the related Mortgage Property which i does not permit. A closed-end loan on the other. Means any extension of credit other than an open-end loan.

Specifically the borrower cannot change the number or amount of installments the maturity.

Loan Vs Mortgage Difference And Comparison Diffen

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Chapter 6 Consumer Credit Ppt Download

What Is Closed End Credit Cash 1 Blog News

Open Vs Closed End Leases What To Know Credit Karma

Federal Register Truth In Lending Regulation Z

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Personal Finance Test H Closed End Credit Investorwords Com Closed End Credit Hide Links Within Definitionsshow Links Within Definitions Definition Credit Ppt Download

Loan Product Definition Sub Products

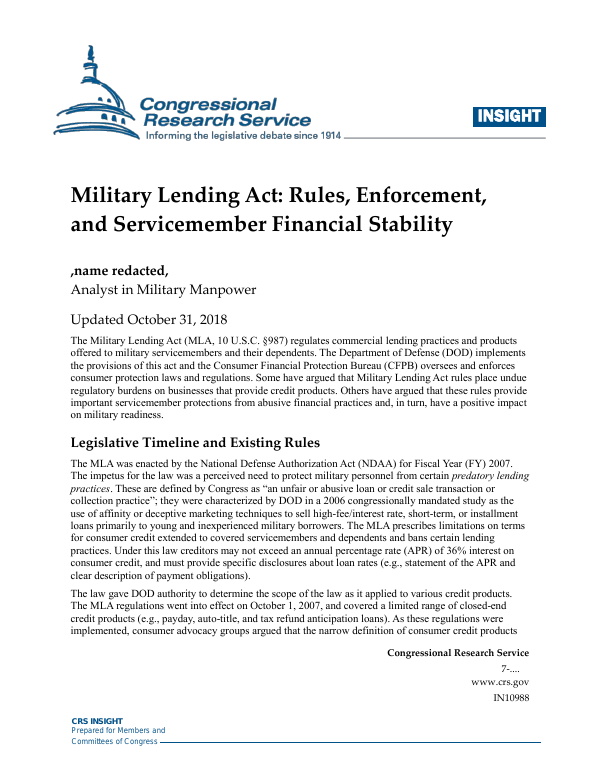

Military Lending Act Rules Enforcement And Servicemember Financial Stability Everycrsreport Com

What Is Closed End Credit Experian

How A Closed End Fund Works And Differs From An Open End Fund

:max_bytes(150000):strip_icc()/state-by-state-list-of-statute-of-limitations-on-debt-960881-17dca963dbe14826877ea1e67a87451e.jpg)

Debt Statutes Of Limitations For All 50 States

Lines Of Credit Types How They Work How To Get Them

Understanding Finance Charges For Closed End Credit

Closed End Credit A Word Cloud Featuring Closed End Credi Flickr

What Is A Loan Types Of Loans Advantages Disadvantages Video Lesson Transcript Study Com

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)