santa clara county property tax credit card fee

Our network attorneys have an average customer rating of 48 out of 5 stars. Confidential Marriage License 8300 Pay with cash check or creditdebit card 250 convenience fee for credit and debit cards Get Married.

211 Bay Area 211bayarea Twitter

Funds available within 24 hours.

. The fee for this service is 8000 payable by cash check or debitcredit card 250 convenience fee. Get the right guidance with an attorney by your side. San Jose CA 95113 For the filing fee see the section Ex parte application requiring a party to give notice of the ex parte appearance to other parties on the local fee schedule.

It does not reduce the amount of taxes owed to the county In California property taxes are collected at the county level. Applicants must file claims annually with the state Franchise Tax Board FTB. The county where the couple plans to apply for a marriage license.

Transaction and billing data including the Service purchased billing details financial data corresponding to your selected method of payment eg. Doing Business with the City. Property owners will get relief since the basis of computing property tax has been reduced from 50 of to 25 of the guidance value.

Accepts VisaMasterCard credit or debit card. A credit card or a bank account number. TOTCommunity Facilities District Tax.

Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. Family Court Family Law Division 191 No. Standard Marriage License 8000.

We had more than 72000 members worldwide. The fee for Credible Witnesses is 20. Accepts cash VisaMasterCard credit or debit card.

If you were divorced in Santa Clara County send your request to. The license fee is non-refundable and includes one certified copy. Identification and proof of age is required of all persons.

Filing fee and publication fees vary from county to county. You can also get a referral to a lawyer from the Santa Clara County Bar Association. For banking by telephone to find an ATM or to speak to a Star One phone representative for assistance with this website please call us at 866-543-5202 or 408-543-5202.

Funds available within 24 hours. Santa Clara County General Information. STREET DIMENSIONS and street property line locations in public right-of-way.

Make sure you review your tax card and look at comparable homes. At this time we also opened our San Jose branch on Blossom Hill Road while closing our branch in Austin. Pay the license fee.

San Bernardino San Diego San Francisco San Joaquin San Luis Obispo San Mateo Santa Barbara Santa Clara Santa Cruz Shasta Sierra Siskiyou Solano Sonoma Stanislaus. You may also want to refer to our Free Low-Cost Legal Aid page. Their phone number is 669-302-7803.

Close credit card and other charge accounts that are only in your spouses name. Aid is a specified percentage of the tax on the first 34000 of property assessment. Average property tax in California counties.

Both parties must appear at the County Clerks Office with proof of age proper identification and pay a license fee of 35 by check cash money order debit or credit card. Tax will be revised in Bengaluru too and user fee will be traded for increase in property tax which now stands dropped by the government. To facilitate your payment and billing for Services facilitate payroll and tax Services for our Customers and detect and prevent fraud.

In 2006 we celebrated our 50th anniversary with Star One growing into the largest credit union based in Santa Clara County and the 17th largest in the nation. Accepts and posts transactions 24 hours a day 7 days a week 365 days a year. More Help with Property Probate.

Closing and Distributing the Estate. Located at the Main Jail and Elmwood lobbies.

Income Limits Before Tax Deductions Start Phasing Out

Stimulus Checks The States Releasing New Payments For May 2022 Marca

Is There A California Tax Credit For Solar Panels Enlightened Solar

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

The Unity Council Theunitycouncil Twitter

Fine Missouri Fuel Tax Refund Form 4925 In 2022 Tax Refund Tax Refund

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

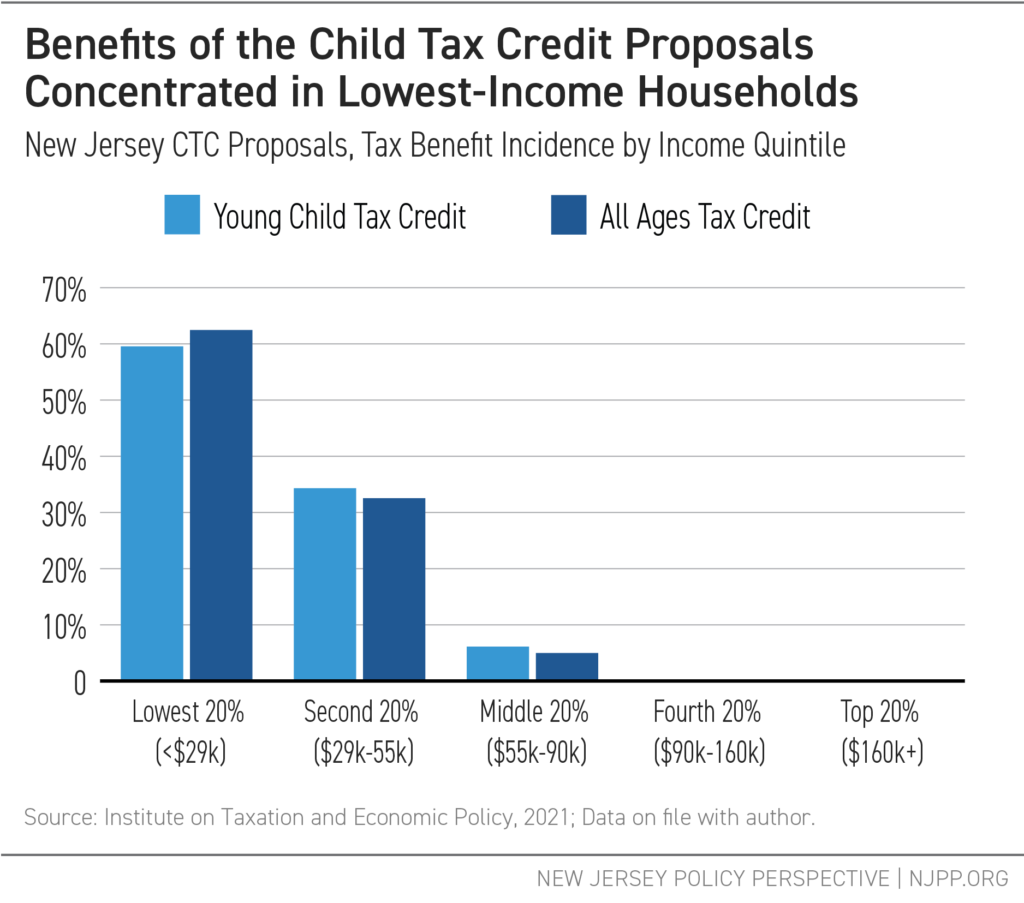

Report Archives New Jersey Policy Perspective

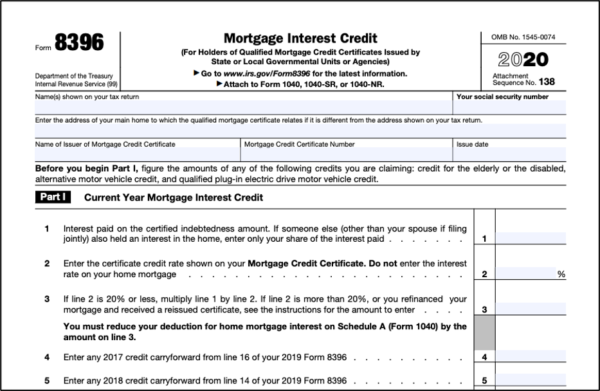

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

Do You Know What Dmv Fees Are Tax Deductible Fair Oaks Ca Patch

Property Taxes Department Of Tax And Collections County Of Santa Clara

County Of Santa Clara Old License And Certificate Of Marriage Signed By Brenda Davis Marriage Signs Lease Agreement Free Printable Santa Clara County

Is There A California Tax Credit For Solar Panels Enlightened Solar

New Santa Cruzian Brings Tax Relief Solution Santa Cruz Works